White label investment technology providers offer bespoke IT platforms that clients use to realize and manage private investments.

Specialized in developing investment-specific management platforms, white label tech providers need to offer their clients end-to-end systems that allow them to cover the entirety of an investment cycle, from pre-investment and due diligence to management and exit.

The challenge for white label services is how to manage the software they provide to multiple clients — and their diverse markets, areas of operation and compliance responsibilities.

Providing the technological architecture of their clients’ investment processes is a significant responsibility that has both a financial and a legal dimension:

Effective KYC/AML checks do not simply mean obtaining investors’ identity details and addresses. Different jurisdictions have different requirements for KYC/AML, and the way in which this information is obtained and verified is critical to the compliance process.

In order to comply with most KYC/AML regulations as stipulated by global regulatory watchdog the Financial Action Task Force (FATF), onboarded investors need to also be periodically screened with ongoing monitoring.

Changes to an investor’s risk profile need to be flagged and this new information integrated into how the investor is treated with regards to compliance.

KYC-Chain offers solutions specifically designed for white label tech providers seeking an API-first approach to their software product offerings.

Our fully-integratable onboarding platform includes proprietary technology designed to allow white label services to easily manage the software they provide to their own clients.

KYC-Chain’s Multi-Scope tool is a proprietary tech feature that we have recently added to our end-to-end onboarding workflow.

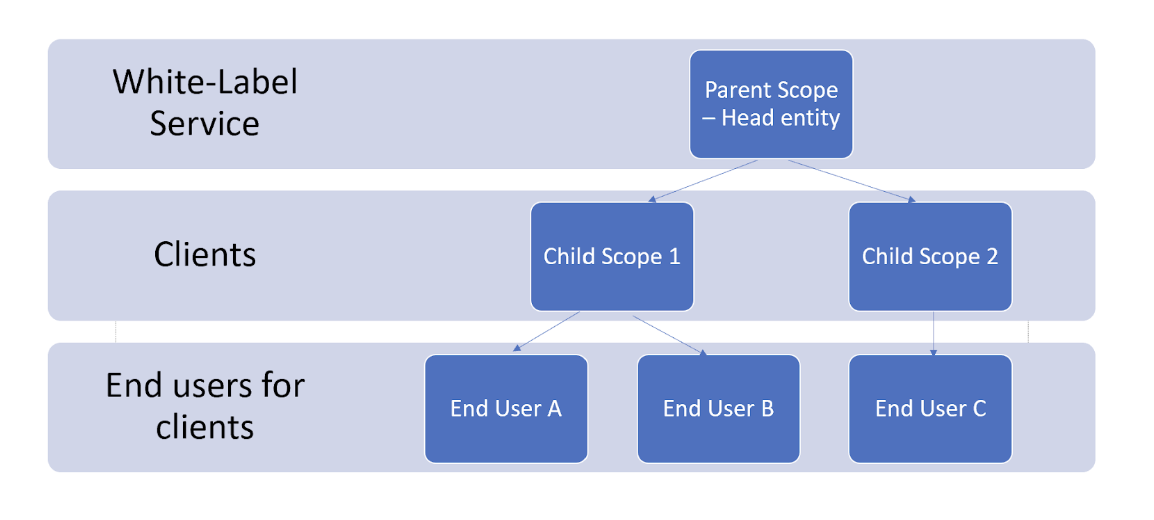

Multi-Scope is designed for a wide range of use cases where our clients need to manage and control multiple onboarding scopes for their own individual projects. In the case of white label investment tech providers — multiple clients engaging in investment activity.

With Multi-Scope, each individual client’s KYC processes — collectively termed a ‘scope’ — can be configured individually, ensuring compliance with the unique KYC/AML regulations that apply to the given jurisdictions of each clients and their investors.

A white label tech provider can use Multi-Scope to create a ‘child’ scope for each client that uses their software. Each client will then be able to onboard the end users using the software, with each user being channeled into each siloed child scope.

This is vastly more efficient than how many white label tech providers currently carry out the process using legacy solutions, which involves mobilizing separate instances for each client — with significant added costs. Alternatively, some legacy solutions also involve co-mingling all of a white label providers’ clients’ end user data in the same instance, which is neither efficient or compliant with many data privacy regulations.

With Multi-Scope, white label tech providers can manage all of their various clients’ processes in one platform, without ever having to co-mingle their individual clients’ data.

Multi-Scope’s benefits include:

Client risk and onboarding

Using thorough and consistent KYC checks, white label investment tech providers can accurately identify high-risk investors for their clients and process them according to the necessary level of customer due diligence.

Create instant corporate structure visualizations

Understanding the corporate structures and beneficial ownership of clients can be very challenging for human compliance teams. KYC-Chain’s Instant Company Structure Visualization tool visualizes how a group of companies relate to each other, as well as who their beneficial owners are and their jurisdictions. This is a powerful capability for understanding corporate investors.

Manage all investments in one platform

Using KYC-Chain’s Multi-Scope tool, you can manage numerous investment ecosystems in one single unified platform, providing you with greater transparency and control over investor onboarding.

Comply with regulations

KYC-Chain’s end-to-end onboarding solution allows for full compliance with a diverse range of global regulatory regimes. Our technology also allows for advanced adverse media, sanctions and political exposure checks, ensuring investment tech providers have a comprehensive understanding of the transactions being carried out on their platforms.

Protect assets and reputation

Using our advanced AML/KYC technology, white label service providers and the clients they serve can avoid regulatory censure, have clear and consistent records of compliance processes and protect their reputation from unwanted exposure to financial criminals or malicious actors.

KYC/AML checks play a crucial role in maintaining the integrity and security of the investment process. By verifying the identity and legitimacy of investors and other transactional actors using their platforms, white label tech providers can ensure the processes they manage are carried out compliantly and securely for both investors and investees.

Using advanced compliance technology such as KYC-Chain’s Multi-Scope tool allows white label tech providers to have a structured and streamlined overview of their clients’ individual onboarding processes, ensuring compliance with national and global AML regulations while also protecting their clients’ business from the threat of fraud and other financial crimes.

If you’re interested in finding out more about KYC-Chain’s end-to-end workflow and Multi-Scope tool, get in touch and we’ll be happy to arrange a demo. You can also now get a first hand experience of the power of our onboarding tool with a free 5-day trial.

How to be compliant with KYC AML regulations in the Post-AI Age

How to be compliant with KYC AML regulations in the Post-AI Age How to Perform KYC on Offshore Companies

How to Perform KYC on Offshore Companies Maintaining KYC, AML & CTF Compliance across Multiple Jurisdictions for Crypto Firms

Maintaining KYC, AML & CTF Compliance across Multiple Jurisdictions for Crypto Firms